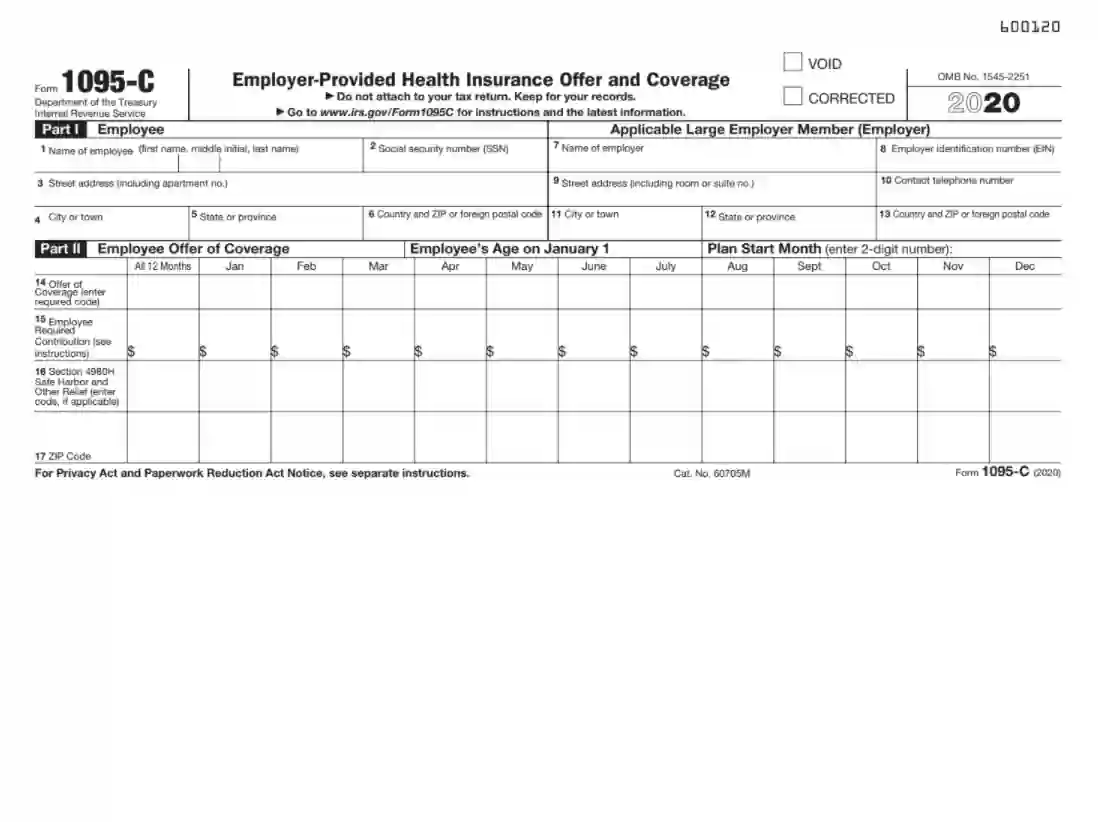

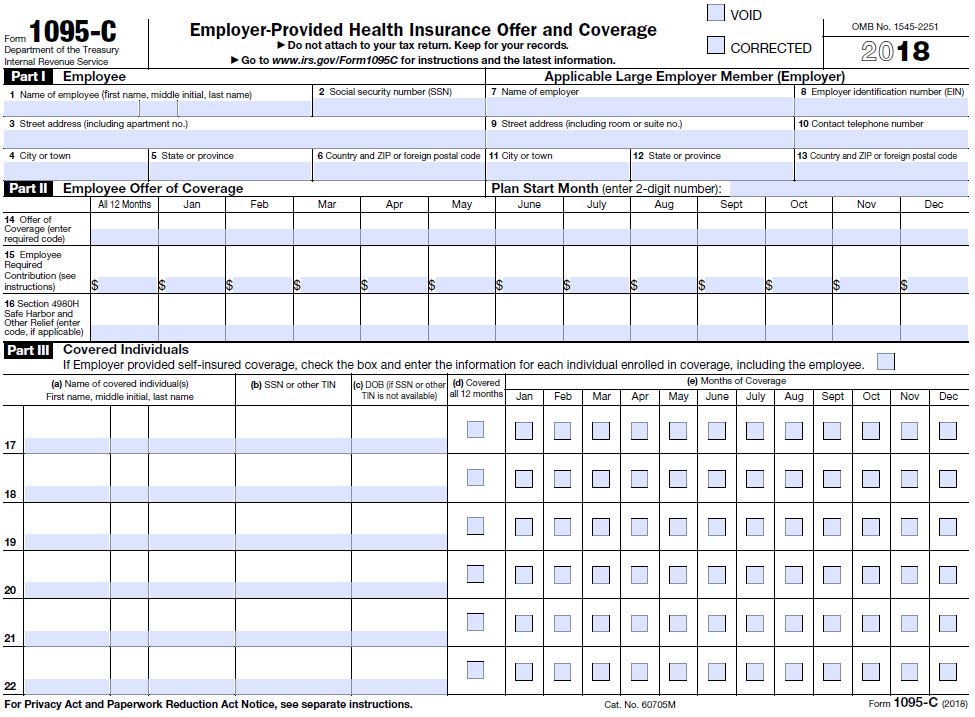

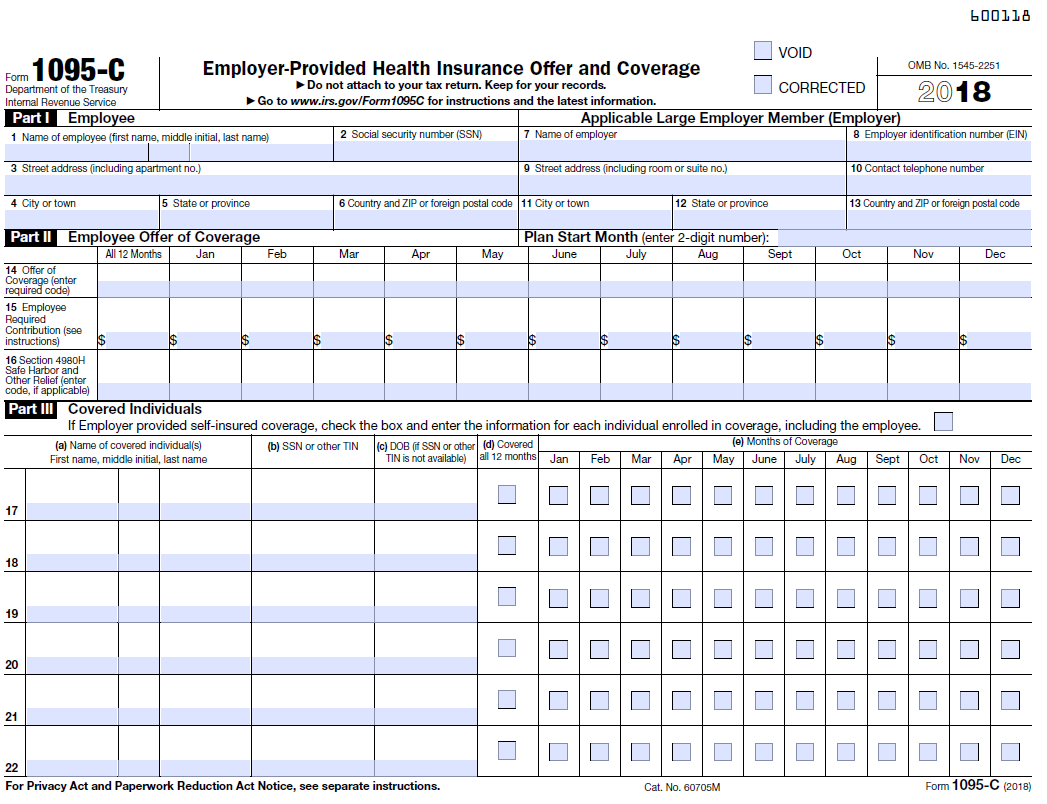

· Form 1095C is sometimes mistakenly referred to as the ACA version of the W2 In reality, the only similarity between a W2 and a 1095C is their production time A W2 form must be produced for all employees at all organizations By contrast, a 1095C must be provided only for some employees at many, but not all, organizationsForm 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out by theCreating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to

What Is The Irs 1095 C Form Miami University

1095-c image

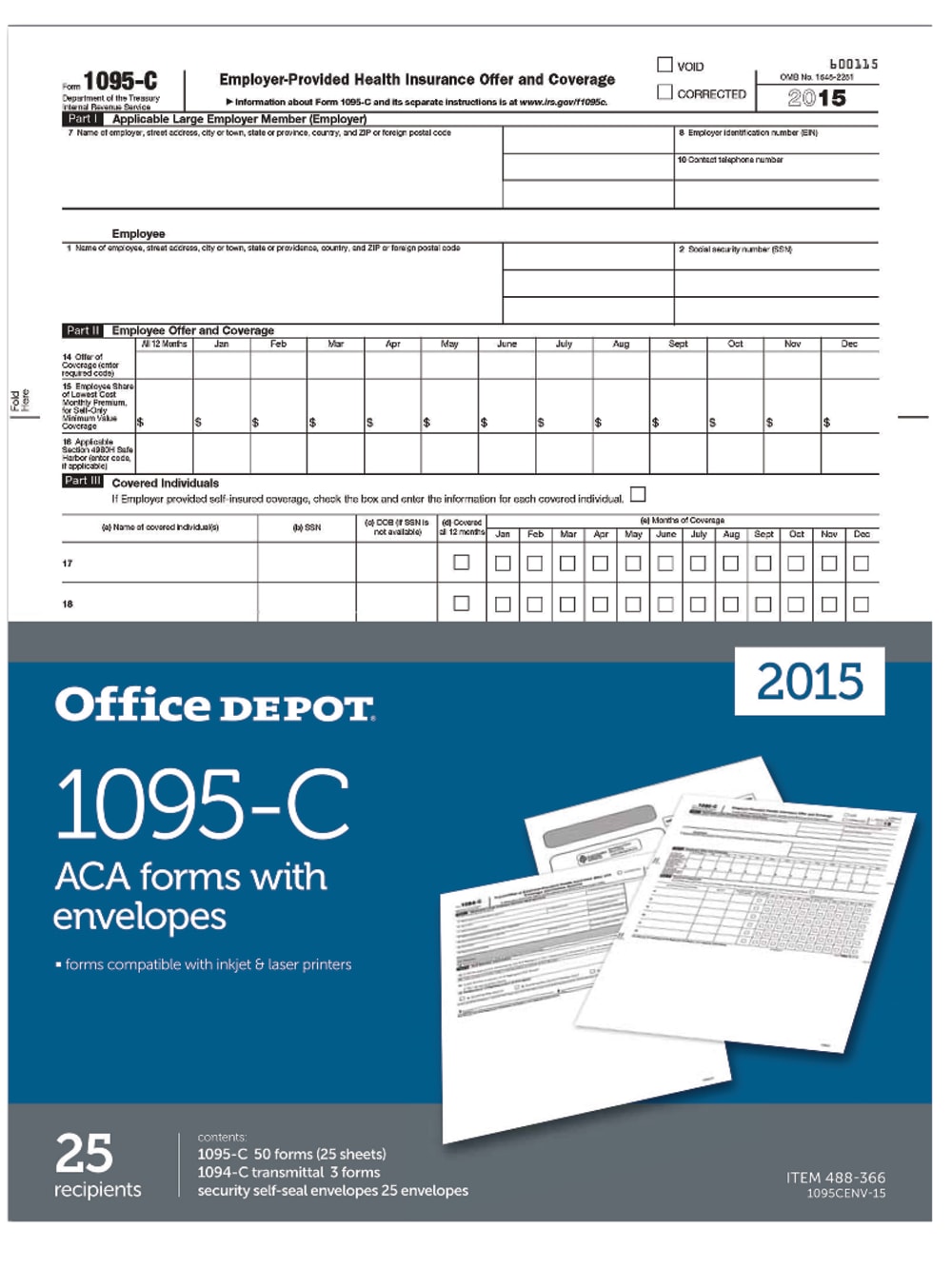

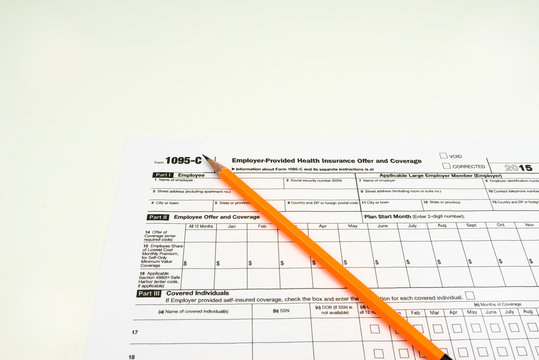

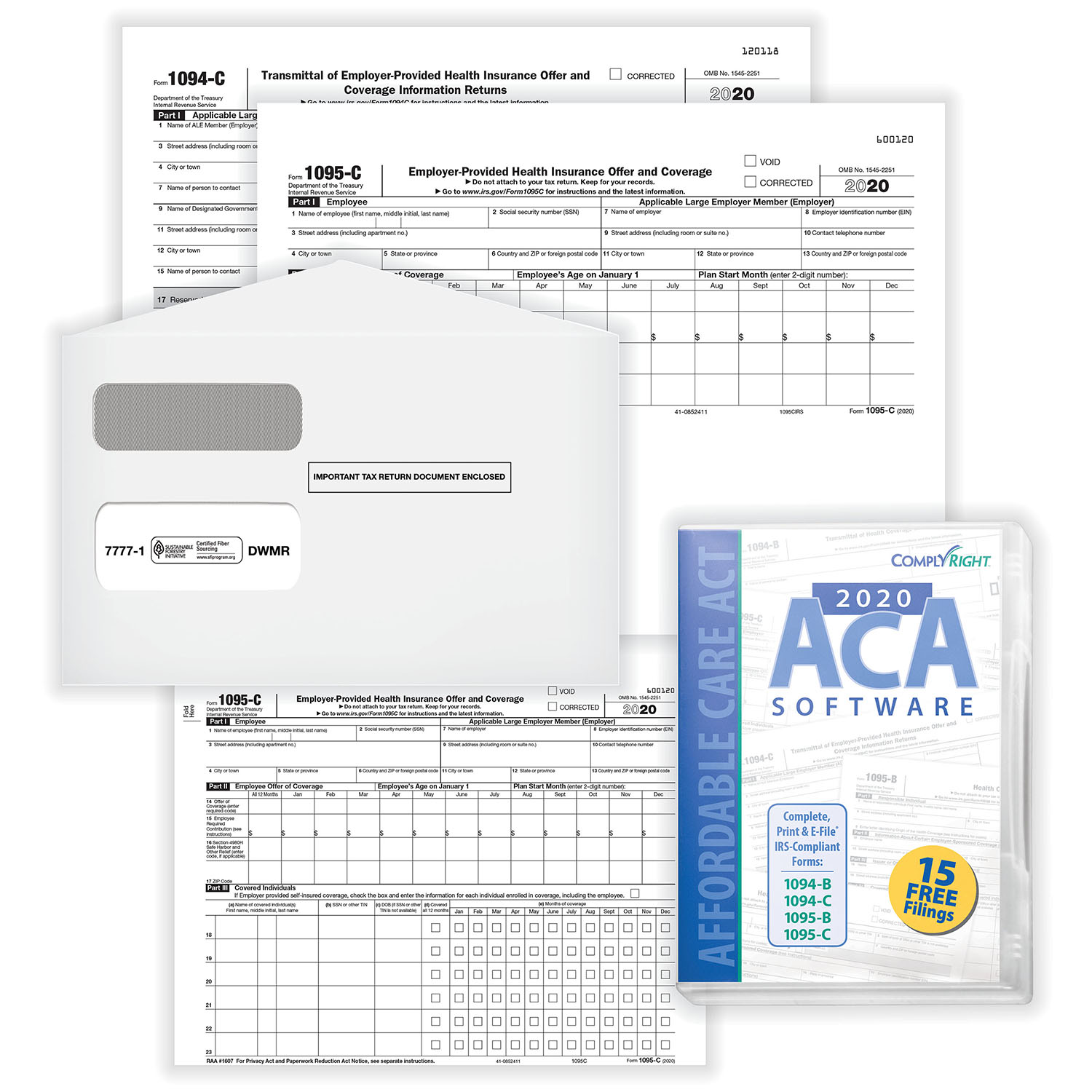

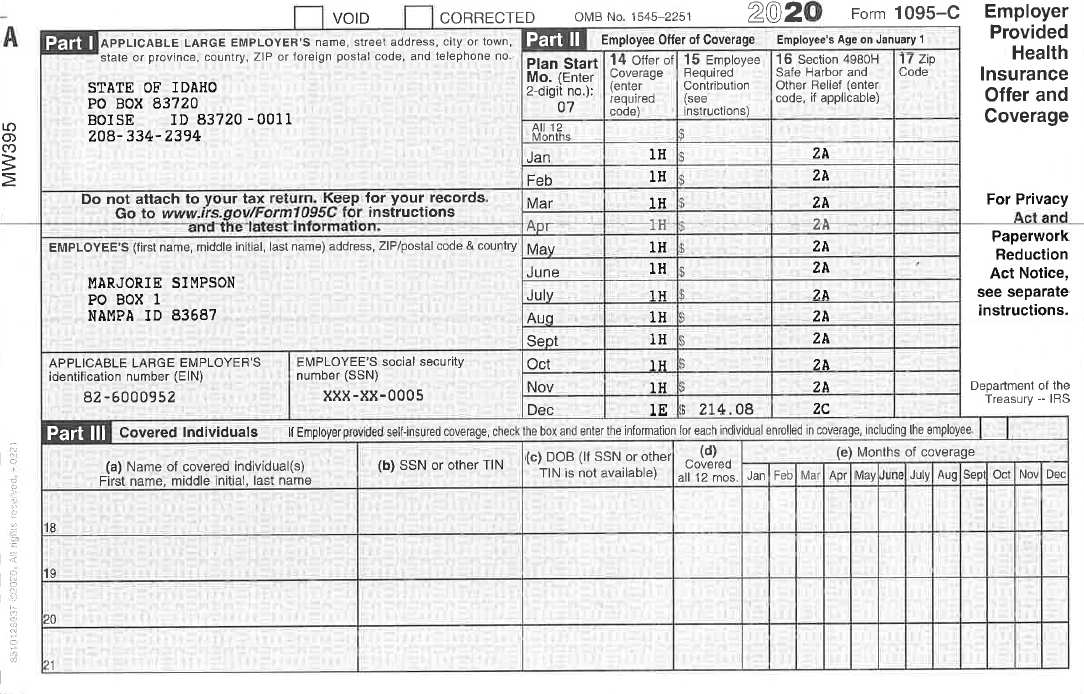

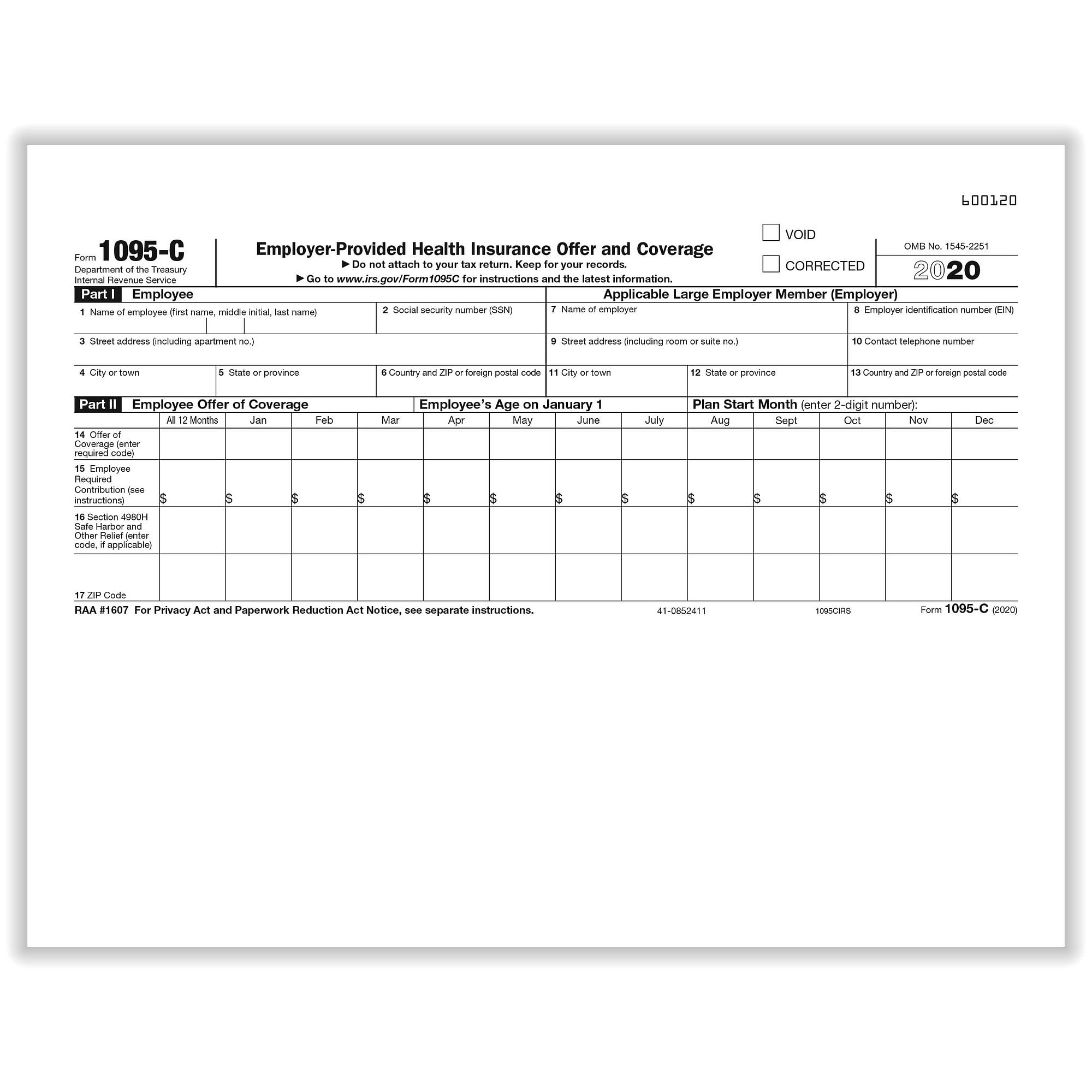

1095-c image-18 ComplyRight AC1095E150 1095C EmployerProvided Health Insurance Offer and Coverage Form and Envelopes, Bundle for 50 Employees 30 out of 5 stars 2 $4121 $ 41 212402 · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095

Section 6056 Large Employer Reporting Ts1099 Ts1099

Click to view larger image Click to view larger image Step 6 Review, Edit and Print Forms 61 Print Forms for employees After you import data, you can click the top menu "Current Company" then "Form 1095C" to view the form list Please do not forget to click the "Refresh List" button · Upon receipt of the Form 1095C, the IRS verifies whether the individual's name and tax identification number is correct by matching it against aIf you were determined to be a fulltime employee of the Commonwealth, the MBTA or Massachusetts School Building Authority (MSBA) under the ACA rules, you will receive a Form 1095C The Affordable Care Act requires Applicable Large Employers having more than 50 Fulltime employees working an

Find & Download Free Graphic Resources for 1095 C 1 Vectors, Stock Photos & PSD files Free for commercial use High Quality ImagesHigh quality 1095 C images, illustrations, vectors perfectly priced to fit your project's budget from Bigstock Browse millions of royaltyfree photographs and illustrations from talented photographers and artists around the globe, available for almost any purposeInstructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C EmployerProvided Health

Applicable Large Employers hiring over 50 employees have to use 1095 C Form This document should contain information for employerprovided Health Insurance Offer and Coverage Every fulltime employee has to meet certain health standards For its part, every ALE should pay, record and report insurance expenses to the Internal Revenue ServiceBy Philip A Davis (image processing) and Kenzie J Turner (cartography) Prepared in cooperation with the Afghan Geological Survey and the Afghanistan Geodesy and Cartography Head Office under the auspices of the US Agency for International Development AGS OpenFile Report (211/212/217/218) C · IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage Insurance," is a new document that your employer may send you this tax season This is the first tax season that this form

Irs Form 1095 C Fill Out Printable Pdf Forms Online

1094 C 1095 C Software 599 1095 C Software

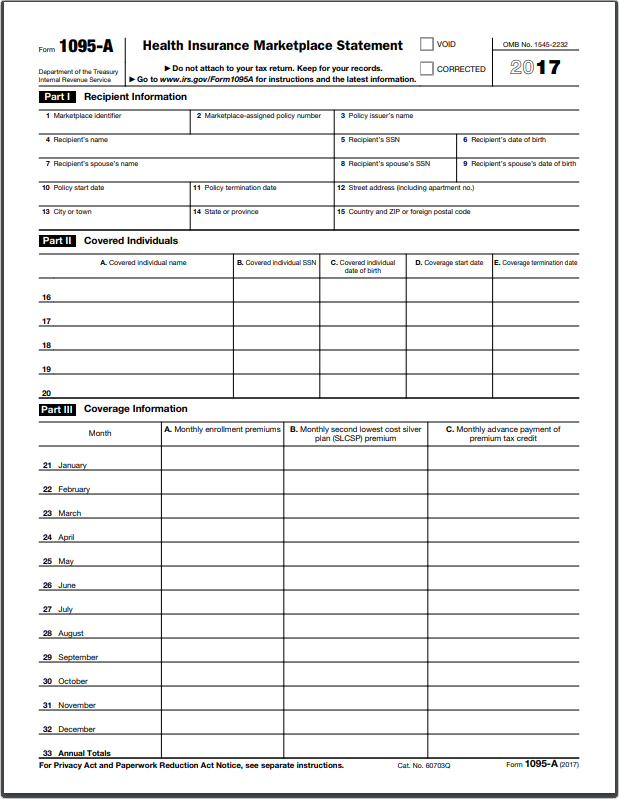

10 · Click on any of the form names below to view the form The link contains the "Instructions to Recipient" page, too Form 1095A Anyone who purchased health insurance through the marketplace at healthcaregov will receive this form These taxpayers should wait until they receive the 1095A to file their income taxes–Must ask the TP about circumstances –Note Questions 13 & 14, Questions and Answers on the Premium Tax Credit, on irsgov •ER coverage is affordable if premiums for selfonly coverage ≤ 966% HHI (16)Click image to view Enhanced Reporting Passport's 1095C software reports identify when an offer of coverage will be needed, and it ensures that coverage meets affordability standards Other reports to help you stay on top of things include the ALE Calculation,

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

What Is The Irs 1095 C Form Miami University

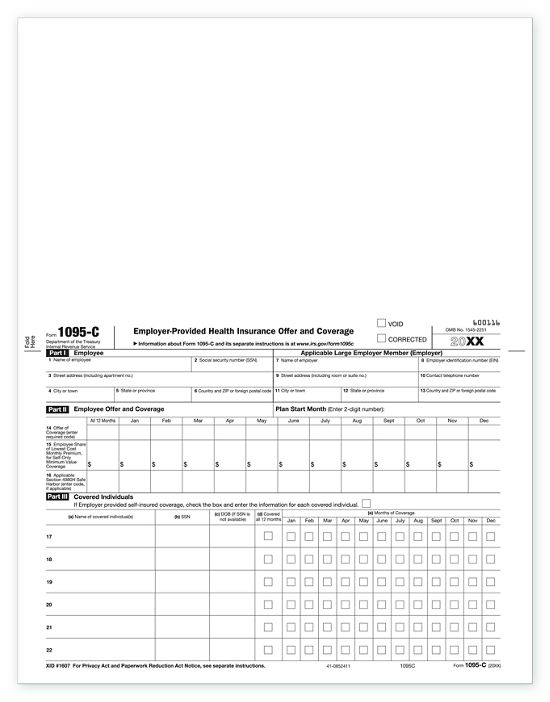

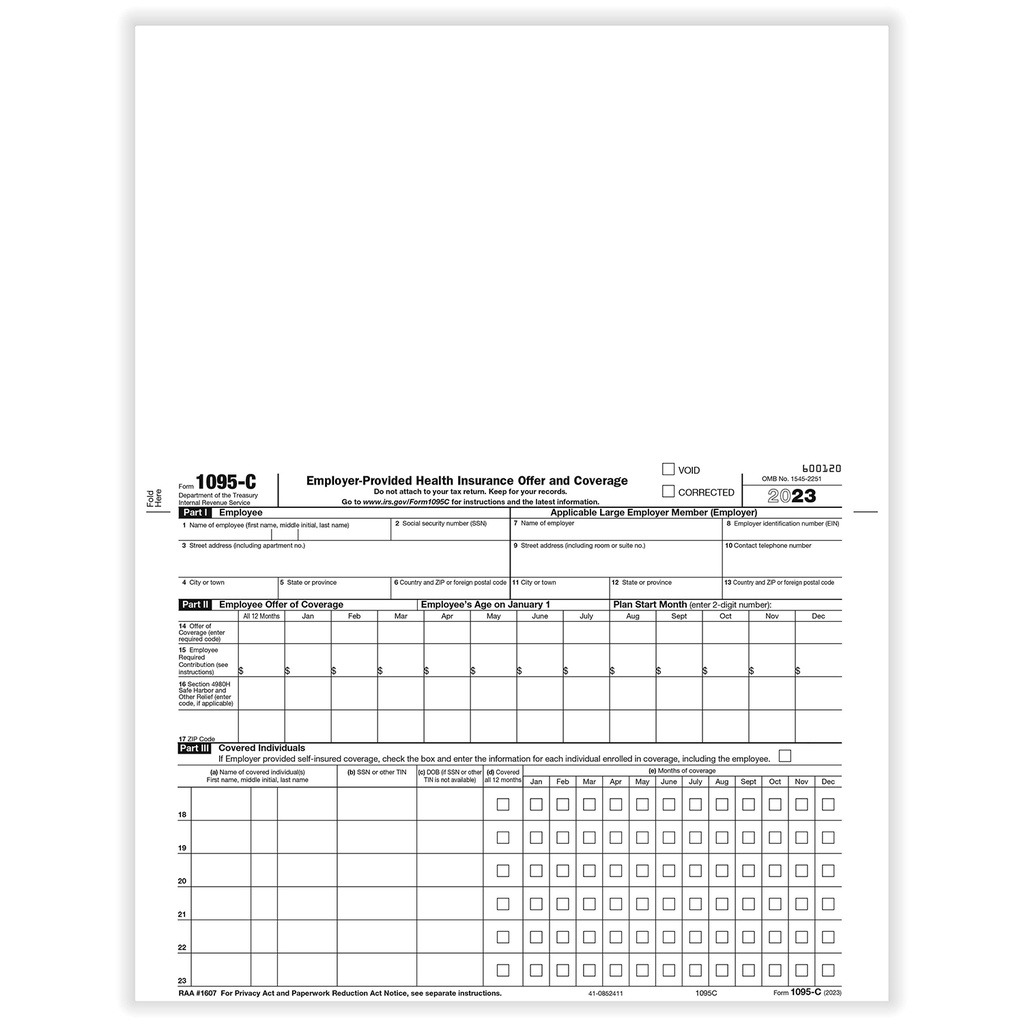

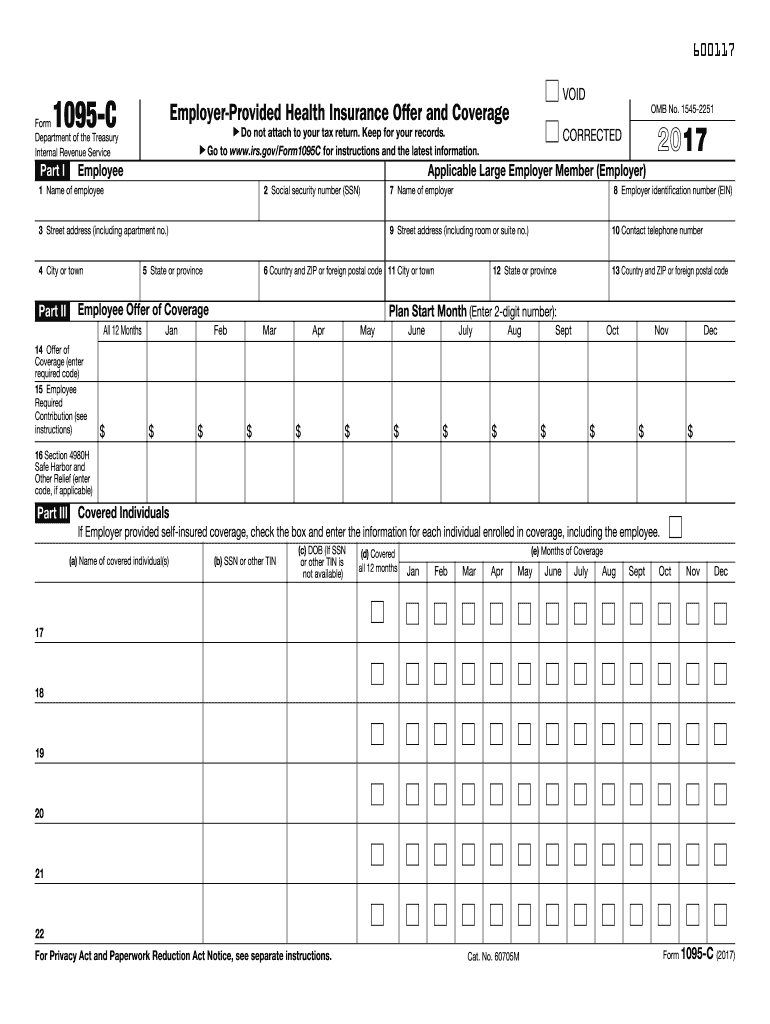

Step 6 Complete Forms 1095C » Codes for Lines 14 and 16 updated •Codes 1I and 2I no longer available—related to outdated transition relief •Codes 1J and 1K added—related to spousal offers of coverage which are conditional » Label for line 15 updated to better reflect what the IRS isWith so many changes with the new Affordable Care Act or ACA, we are just beginning to understand the bigger picture of it all Check out this video for morUse the View Form 1095C page (ACA_EE_YE_FORM) to view the Form 1095C Whether or not the employee has consented to receive electronic forms, the employee's 1095C forms will appear on this page Once the form is released, a link appears on this page The link opens the PDF Form 1095C for viewing

Form 1095 C Payroll Baylor University

Office Depot

0321 · The IRS extended the deadline to provide employees with copies of their 1095C or 1095B health coverage reporting forms from Jan 31 to March 2, 21, and again extendedDownload all free or royaltyfree photos and vectors Use them in commercial designs under lifetime, perpetual & worldwide rights Dreamstime isForm 1095C Codes are used to report the employees' health coverage information on Line 14 & 16 Check our 1095C Code cheatsheet for Section 4980h safe harbor codes

What S New For Tax Year Aca Reporting Air

21 Bulk Laser 1095c Employer Provided Health Insurance Deluxe Com

Sample 1095 C form for Year and later Sample 1095 C form for Year 15 to 192910 · ACA Form 1095C Filing Instructions An Overview Updated October 29, 800 AM by Admin, ACAwise When the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employeesComplyRight 1095C Tax Forms Set, EmployerProvided Health Insurance Offer and Coverage Forms with Envelopes, Laser, 81/2" x 11", Set for 50 Employees $4379 $ 43 79 FREE Shipping

Tax Form 1095c Tax Form Details With Light Background Stock Photo Download Image Now Istock

Irs Form 1095 C Uva Hr

1095 18 Printable Fill out, securely sign, print or email your 1095 c form 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start aIf submitting forms 1095C in batches or another party is filing some of your organization's 1095C forms, enter the total number of forms 1095C submitted by and/or on behalf of your organization for the reporting year Troubleshooting Troubleshooting 1094B, 1094C, 1095B, and · If the Form 1095C has been filed with the IRS, a new, fullycompleted Form 1095C with the correct information must be submitted An "X" entered in the CORRECTED checkbox on the form The Form 1094C transmittal (not marked corrected) with the corrected 1095C forms must be filed with the IRS, and the employee must receive a copy of the revised Form 1095C

Irs Form 1095 C Fauquier County Va

Aca 1095 C Basic Concepts

COBRA coverage under the ACA is confusing So many possible scenarios, which code goes where?0907 · 1095C, EmployerProvided Health Insurance Offer and Coverage — Employers who have at least 50 fulltime employees must send out this form to each worker and to the IRS It provides details on who has been offered employersponsored healthcare coverage, whether workers have chosen to take advantage of that coverage, and if so, what months you were orYou are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to

Your 1095 C Tax Form My Com

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

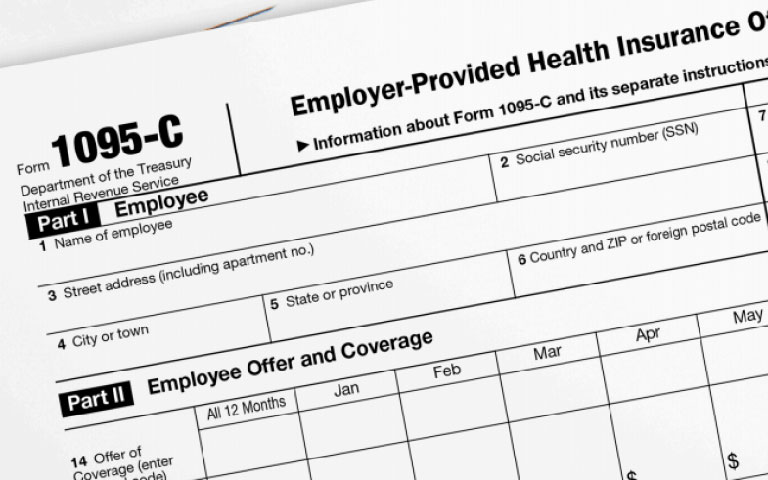

TIP Employers are required to furnish Form 1095C only to the employee As the recipient of this Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records Part I Employee Line 2 This is your social security number (SSN) · You don't need Form 1095C to file your tax return TurboTax will ask you questions about your health coverage but your 1095C isn't needed Just keep the form in your files To enter your Form W2 in your tax return, you can either import (if it is supported by your employer), take a picture of it, or manually input the informationBerger Hello I´m Tim Berger, and I thank you for attending this session about the Affordable Care Act Today, my copresenter, Anna Falkenstein, and I are here to discuss the correction process for ACA Information Returns Before we get started, let me tell you a little bit about us

Hr Updates Theu

Irs Form 1095 C Codes Explained Integrity Data

· Filing Forms 1094C and 1095C By Mail Getting Started With ACA Compliance Health Plan Requirements Under the ACA Limited NonAssessment Periods LookBack Method for ACA Compliance Missing Data for ACA Compliance NonDiscrimination Under the Affordable Care Act0602 · Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by February 28, , if they are filing on paperOn Form 1095C statements furnished to employees, the Social Security Number can be truncated to show only the last four digits of the SSN and replace the first five digits with Xs By default the masking option is turned on (ie checkbox selected) Report Name The Report Name identifies each form option for Form 1095C

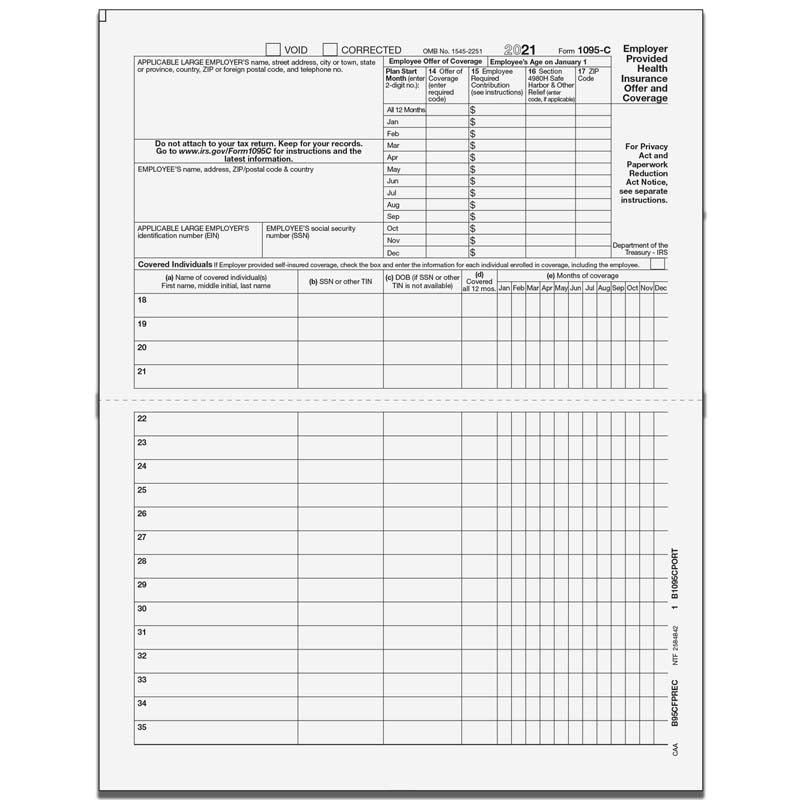

Pressure Seal 1095 C Form Ez Fold Discount Tax Forms

1095 C Preprinted Portrait Version With Instructions On Back

IRS Form 1095C is a statement provided by an Applicable Large Employer (ALE) to each of its employees who were eligible for coverage in the previous year The form helps the IRS enforce the ACA employer mandate by monitoring the type and cost of coverage offered to employees, and the number of employees who were offered this coverage Form 1095C provides details toForm 1095A vs Form 1095C •1095A with PTC in months that 1095C shows affordable coverage?Here we discuss common COBRA situations and how to code them

Irs Formular 1095 C Arbeitgeberorientierte Krankenversicherungsangebote Und Deckungssteuerleere Finden Sie Auf Der Leeren Kalende Redaktionelles Stockbild Bild Von Intern Wirtschaftlichkeit

1095 C Employer Provided Health Insurance Offer 500 Sheets

· Form 1095C may be sent electronically like the W2 if the IRS electronic distribution requirements are met, but the employer must receive consent from the employee separate from the W2 All of the 1095C forms must be submitted with the 1094C If you are filing over 250 1095C forms, you are required to file electronically February 28th, 16 · As with most IRS forms, the Form 1095C acts as a way for the employer to report the health coverage that an employer made available to each employee Specifically, the form identifies the employee/employer relationship, what months the employee was eligible for coverage, and the cheapest monthly premium available to the employee under the plans offeredNote ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;

Common Mistakes In Completing Forms 1094 C And 1095 C

Section 6056 Large Employer Reporting Ts1099 Ts1099

1095C forms are typically mailed the last week of February A Reminder on Returned 1095Cs If an employee has a change of address on file with the US Post Office, their 1095C will be automatically forwarded by the post office The only 1095C's that will be returned to the State Controller's Office will be those marked as UndeliverableForm 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employeeIRS Form 1095C is filed with the IRS by the applicable large employer (ALE) who offers health coverage and enrollment in health coverage for their employees Employers with 50 or more full time employees are considered ALEs Employers use 1095C Form to report the information required under section 6056Also it is used to determine whether an ALE Member

1095 C Continuation Forms For Complyright Software Discount Tax Forms

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

All fulltime employees at companies with more than 50 fulltime employees will now receive a Form 1095C to report health care coverage offered by their empWhat is IRS Form 1095C?3112 · Find 1095 c stock images in HD and millions of other royaltyfree stock photos, illustrations and vectors in the collection Thousands of new, highquality pictures added every day

Aca Update Form 1095 C Deadline Extended And Other Relief

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Select 1095C from the Form Type dropdown list In the Year field, select the year for the 1095C forms you want to process and then click the Refresh button In the Employee Data tab, click the plus sign next to the client ID to expand the list of employees, and then mark the checkboxes for the employees whose 1095C forms you want to processPlease note the form used in the pictures are not actual 1095C forms and your 1095C will not have the appearance of the form in the picture How to Consent to Receive a 1095C Online (PDF) How to get Your Original 1095C Online (PDF) Obtain a

55 Best 1095 C Images Stock Photos Vectors Adobe Stock

Affordable Care Act Form 1095 C Form And Software Hrdirect

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

What Is Form 1095 C And Do You Need It To File Your Taxes

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Irs Formulare 1095 A 1095 B Und 1095 C Leere Kalenderseiten Mit Stift Und Dollarnoten Stockfoto Bild Von Formular Geschaft

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Form 21 Irs Forms

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs 1095 C Form Pdffiller

Form 1095 C Forms Human Resources Vanderbilt University

Code Series 1 For Form 1095 C Line 14

1095 C Images Stock Photos Vectors Shutterstock

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Ez1095 Software How To Print Form 1095 C And 1094 C

1095 C Employer Provided Health Insurance Offer Of Coverage

Tax Form Preparation Software 1095 C Software To Create Print And E File Forms 1094 C 1095 C

1095 C Eemployers Solutions Inc

Irs 19 Form 1095 C Now Online Stuttgartcitizen Com

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Images Stock Photos Vectors Shutterstock

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

1095 C Form Official Irs Version Discount Tax Forms

Amazon Com Egp Irs Approved Laser 1095 C Employer Provided Health Insurance Tax Form Quantity 100 Office Products

Form 1095 C Guide For Employees Contact Us

1095 C Forms Complyright Software Version Zbp Forms

Irs Form 1095 C Mymontebenefits Com

What Payroll Information Prints On Form 1095 C To Employees

1095 C Irs Employer Provided Health Insurance Offer And Coverage Form Landscape Version 300 Sheets Pack

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Formulare 1095 A 1095 B Und 1095 C Liegen Auf Leeren Kalenderseiten Stockbild Bild Von Bargeld Finanziell

1095 C Faqs Mass Gov

Sample 1095 C Forms Aca Track Support

Electing To Receive Your 1095 C And W 2 Forms Electronically 19 Social Security Wage Base Increase

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

1095 C Employer Provided Health Insurance Irs Copy For 5096l Tf5096l

22 1095 C Stock Photos Images Download 1095 C Pictures On Depositphotos

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Non Full Time Employees May Request A Copy Of Form 1095 C Uncsa

Your 1095 C Obligations Explained

Enroll In Employer Sponsored Health Insurance With Irs Form 1095 C

What Your Clients Need To Know About Form 1095 C Accountingweb

Aca 1095 C Basic Concepts

Sample 1095 C Forms Aca Track Support

Accurate 1095 C Forms A Primer Erp Software Blog

Amazon Com 18 Complyright 1095 C Irs Employer Provided Health Insurance Form Pack Of 100 1095cirsamz Office Products

trix Irs Forms 1095 C

Benefits 1095 C

Posts Department Of Human Resources Myumbc

Overview Of 1095c Form

Changes Coming For 1095 C Form Tango Health Tango Health

What Is An Irs Form 1095 C Boomtax

Irs Formulare 1095 A 1095 B Und 1095 C Liegen Auf Leeren Kalenderseiten Stockbild Bild Von Bargeld Finanziell

Do You Know The Aca Form 1095 C Filing Requirements

1095 C Faqs Office Of The Comptroller

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Code Series 2 For Form 1095 C Line 16

Control Tables And Sample Forms

1095 C Images Stock Photos Vectors Shutterstock

Annual Health Care Coverage Statements

22 1095 C Stock Photos Images Download 1095 C Pictures On Depositphotos

Free 1095 C Resource Employee Faqs Yarber Creative

1095 C 18 Public Documents 1099 Pro Wiki

1095 C Print Mail s

17 Tax Year Affordable Care Act Reporting

Changes Coming For 1095 C Form Tango Health Tango Health

1095 C Form 21 Finance Zrivo

How To Accurately Complete Lines 14 16 On Irs Form 1095 C

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct